Brickser' feed III: Summer is coming, which destination for your vacation/allocation?

A few days ago, while I was indulging in a well-deserved rest in the Arabian baths of Sevilla, I found myself pondering—a thought familiar to anyone who's experienced the city's allure. Navigating the culinary marathon of eating tapas and sipping wine on terraces can be surprisingly taxing, especially in February when your body is scarcely prepared for such endeavors.

This led me to wonder: How could I possibly return to my Parisian abode without devising an escape plan to outwit the winter's end?

Thus began my quest, delving into the digital realms of real estate in search of a new pretext for a weekend getaway. After much deliberation, I narrowed it down to two captivating options: Aix-en-Provence or Vienna. The rustic charm of Provence versus the imperial grandeur of Austria's proud capital.

First, let's take a quick look at Paul Cézanne's hometown with a dive in Aix-en-Provence.

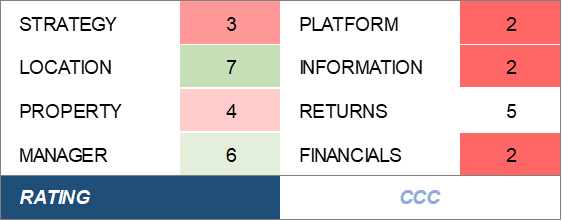

Without cloaking it in mystery, I've decided to bypass Aix-en-Provence this time, and I'll be straightforward about it. However, it's an interesting case because it shows us what the future might hold with the rise of digital/fractional real estate. I'm not pointing fingers at Wally-im.com since it's a new platform still finding its feet with limited resources. However, it clearly outlines numerous investment pitfalls we might face as the area develops. Despite the depth of the sea, without careful scrutiny, it can quickly become a murky crocodile pond:

Limited quality information: It's unclear who's buying or what the fees are. This lack of detail is a big red flag.

Inexplicable returns : The promised financial returns seem to materialize out of thin air. They talk about a total return of 10%, split between a yearly dividend of about 5% to 6% and a capital gain of around 20%. But there's no clear explanation for where these numbers come from, especially the dividend, since we can't see their financial projections. I'm even more concerned about the capital gain claims. There's no proof that a managed apartment in Aix-en-Provence—or anywhere else in France—will sell for more than a regular vacant family home. This seems like a big gamble.

Questionable Institutional Opportunity: The concept of purchasing an apartment with the intent of transforming it into a shared space hardly seems like an institutional-grade investment. Putting this opportunity out there feels like the platform is trying to offload something they can't fund themselves. It seems like something a small group of friends might do, not something that should be marketed to everyone. This approach hardly inspires confidence in the platform's reliability.

On the flip side, there are two notable aspects I find appreciable:

Prime Location: The chosen location is exceptional, and as you're all aware, the significance of location cannot be overstated in real estate investment. It's the cornerstone of value and appeal.

Partnership with a Leading Operator: For their inaugural venture, they've aimed high by partnering with Colonies. This collaboration promises high-quality fit-outs, premier locations, and an immediate boost in occupancy. However, for an endeavor of this scale, involving Colonies also implies substantial fees that add to the platform's charges. It raises questions about how unexpected costs will be handled: What gets priority - paying out dividends, covering these fees (of Colonies? of Wally?), or maintaining the property's value?

In summary, don't be misled—size definitely matters in real estate, and anyone claiming otherwise is not telling the truth. The troubles are the same, whether it's a €500k opportunity or a €100m one, and sometimes they're even greater with smaller investments due to insufficient information. Interestingly, the proportion of fees tends to move in the opposite direction.

Kudos to Wally for their launch. I'll keep an eye on them but will be skipping my vacation in Aix-en-Provence this time.

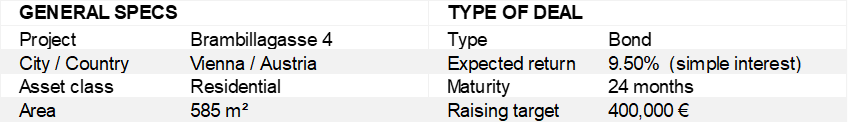

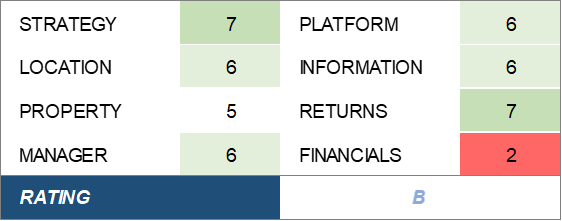

Now, let's journey to the rhythm of Mozart's choruses, setting our sights on Vienna and the Brambillagasse 4 project.

Brambillagasse 4: Financing of a 585 m² residential building already refurbished with additional potential

The general refurbishment that has already been carried out included not only the extension of the building but also the refurbishment of the common parts, such as the central heating system, staircase, façade, etc. The project, already 92% let generates rental income of around €75,000 p.a.

A convenient location: Situated in the Simmering district, close to the Danube and south of the city center, this area is known for its variety, active business scene, and plenty of facilities and services. Positive demographic trends coupled with the project's mere four-minute proximity to Simmering railway station underscore its accessibility and appeal, offering swift commutes to the city's heart.

Experienced Manager: This is appreciable, the Velum Group, conducting this project with expertise, brings a solid history of orchestrating similar refurbishments. Their expertise isn't limited to just navigating platform dynamics (boasting 10 financed projects with two already successfully repaid) but also in executing such refurbishments. With a robust track-record predominantly featuring around similar 500 m² residential refurbishments over the past 15 years, Velum Group's acumen is undeniable.

An already stabilized asset: the product is already mature with a tenancy renewed and almost finalized (92% let). The refurbished product show, despite the absence of floor plan, attractive apartments. The rental income perceived in a solid protection against contingencies and a guarantee for a running maintenance allowing long term capital protection. The possibility of converting the attic represents also a 30% reversion potential.

Stable Investment: The property presents a mature investment opportunity, almost fully leased (92%), showing its appeal even in absence of floor plans available. The rental income offers solid financial security and supports ongoing maintenance, ensuring the building's long-term value. Converting the attic could further increase the property's value by 30%.

Questionable financial structure: But when looking closely on the revenue streams and underlying financial architecture, “Here comes the rain again”. The model's viability appears precarious, with rental income failing to offset debt obligations—a debt yield alarmingly pegged at 0.6x. This issue persists even when factoring in the additional revenue potential from converting the attic space.

Plus, the objectives behind the capital raise are nebulous at best. It predominantly appears aimed at freeing up Velum's equity for redeployment in other ventures. In my opinion, this is a deep red flag. This, further accentuated by the revelation that equity will only constitute a mere 13% of the total project cost. Without knowing more about the quality of the debt, there's real worry about the project's ability to meet its debt obligations in the medium term.

The only mitigating factor seems to be the project's valuation post-refurbishment, which stands 20% below the market rate, potentially offering a fallback liquidity route if they run into financial trouble.

Rendity.com is a solid provider of digital property opportunity in central Europe and this one almost made the cut with a nice project at an advanced maturity level and a manager profiting from significant credentials. Nevertheless, investing crowd-funded money in Real Estate, as appealing as it is, remains a recent and sensitive activity.

Exercising caution is a must. Key questions to ponder include: Where is the money being allocated? Into what exactly? And specifically in this case, for what purpose ? A principal rule I adhere to when evaluating a deal is that the captain should not abandon ship or recover their investment until the vessel has reached calm waters.

Readers, your insights, challenges to the viewpoints shared, or suggestions for future discussions are more than welcome. Please don't hesitate to reach out!

See you next week!