Brickser'feed - II

From WeWork's Ashes: Coworking's Crisis or a Strategy for NOI Revolution?"

Hello readers!

Today’s edition is poised to be something special. I won’t trouble you with the usual painstaking analysis of the Real Estate market (well, maybe just a tad ) or dissect another Property investment scam another platform eagerly pushing our way (fear not, those are lined up for next week). Instead, I will share a snapshot of a recent conversation emblematic of the property market's wild side.

The scene was set last Monday, as I was enjoying a fine cup of tea and reading the crème de la crème of Substack newsletters (shoutout to

) to kickstart the week. This is exactly the moment William (let's call him that, close enough to his real name) chose to ring me! William is a long-standing acquaintance, that I affectionately nicknamed Hugo Boss for his dark hair, glossy loafers and enviable collection of designer suits. He’s now an experienced agent dealing with large prime Real Estate in Paris. Not quite a friend but close enough to exchange like trusted allies, he has my ear and I, his:- “Hi Logan, Happy New year!”

- “Hey there, my friend, the same to you. What’s on your wish list for the new year?”

- “A juicy mandate with even juicier fees!” Their focus never shifts, does it?

- “Speaking of, I need your advice Logan. I'm assisting a client who's being evicted from their WeWork space in Western Paris. WeWork’s dropping the lease, and my client needs a new spot in a few months.”

Of course, I don’t possess a 5,000 m² vacant space in Paris’ Central Business District (CBD) but the heads-up was appreciated.

It’s old news, that WeWork sunk by a disastrous management declared bankruptcy last November leaving its occupants to deal with the aftermath. Shareholders, too, will find themselves empty pocket. As someone who’s navigated the high seas of risk myself, with a deal ore two I’d rather not broadcast, I don’t judge them. That said, I won’t judge you neither if you think that they reaped what they sowed. Dreaming big is commendable but the moment you invest in those dreams and consider to IPO them, you’re inviting the world to question your mental health. The day you strike, you’re a visionary, the remaining 365 days…

Yet, the real intrigue lies beyond the headlines and the question that came up behind: Does WeWork's collapse, as the sector's front-runner, signals the industry’s twilight?

Quick answer : Absolutely not!

The enormity of the tree falling down and the loudness of its reverberations through the majors Western CBDs is overshadowing the vast forest behind this solitary tree. It's crucial to acknowlege that the ecosystem is rich with other robust entities that have weathered storms and cycles.

Take the IWG Group (home to Regus, Spaces, Signature, etc.), as a prime example. It is offering a stark contrast with its adaptable model which has evolved in response to the emergence of WeWork and the various storms that shattered the industry recently. Emerging stronger, IWG has introduced revamped a model emphasizing hybrid work and asset-light management leveraging management contracts or leases with variable rent.

Boasting annual sales of around EUR 3 billion and an EBITDA margin over 40%, it's hard to see IWG as part of a fading industry.

Don’t get me wrong, I am not advocating for this model over WeWork’s. The British company itself sailed in rough waters few decades ago. In fact, setting aside the delusional valuation and the extravagance that comes with the tons of cash throw to the whole management team, its lasting impact is undeniable, a sentiment echoed by UndercoverBroker’s tweet.

The blueprint for today’s office requirements—extensive communal spaces, flexibility, aesthetic benchmarks, and added services—largely mirrors what WeWork brought years ago.

And this has again been reinforced by the pandemic that has strongly highlighted two particular aspects :

Remote work - despite the old guard reservations, remote work has irreversibly become the norm. The challenge lies in nurturing company culture and effective training in a semi-distant framework.

Flexible contracts - Increasingly essential, particularly among smaller businesses. Yet, trapped by our old habits and handcuffed by our appraisers, the industry continues to push long-term leases as long as users allow to do so. Please have mercy on us!

This is the arena where nimble, hybrid working operators have ventured deep into the jungle, sowing seeds in the shadow of institutional inertia. Increasingly, these operators are securing long-term leases on strategically located floorplates, offering SMEs flexibility and practicality at a premium

To me, this trend clearly represents an arbitrage opportunity, bridging the gap between the institutional reluctance to move away from fixed-term contracts and the pressing demand for adaptability among companies in a fast-changing world. In France, locking in for less than three years is a rarity; in London, commitments often stretch to five. Reflect for a moment—where was your company three years back? Consider the number of employees, the fluctuating office attendance from Monday to Wednesday, and your recruitment forecasts. The reality is, business plan rarely unfold as expected and this is no exception.

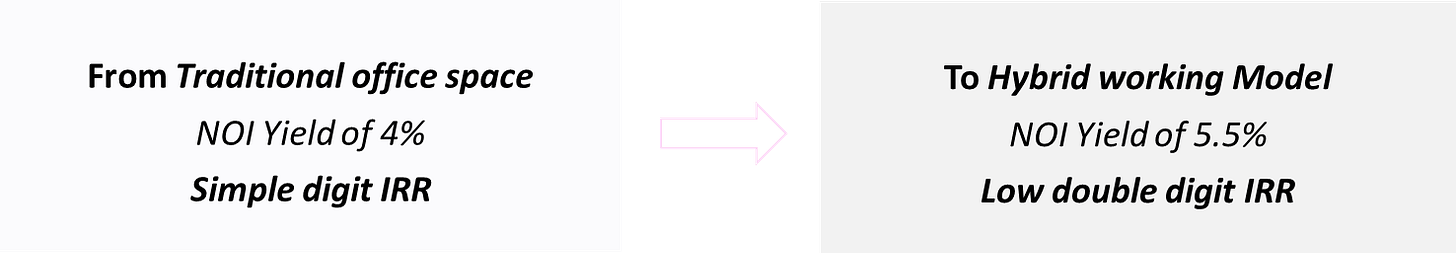

How a Parisian Family office can increase by 50% its NOI in Central Paris?

The gap in the market has been identified, and operators are rushing to fill it, but the question remains: For how long can this continue? The traditional office landscape is undergoing a fundamental transformation, driven by an increasingly apparent need for agility and service. The future of office space management, mirroring the hospitality sector's focus on Average Daily Rate (ADR), Occupancy, and Revenue per Available Room (RevPar), is where the real long-term opportunity lies.

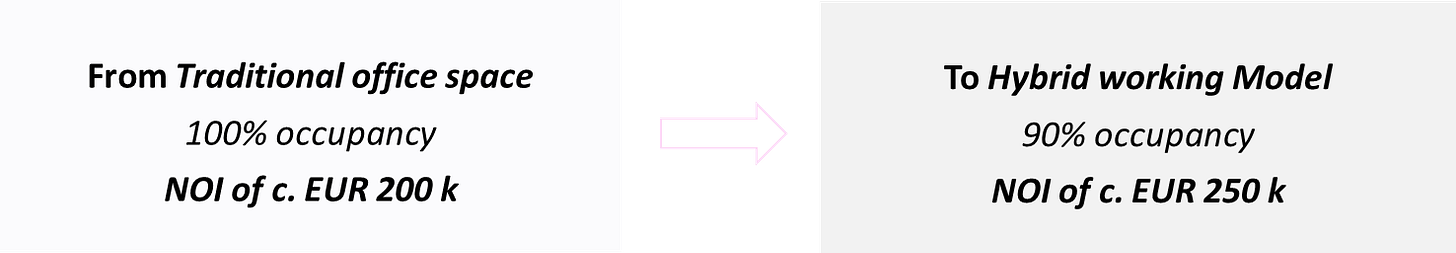

A small French family office has embraced this paradigm, focusing on prime locations to offer flexibility and essential services, thereby boosting their Net Operating Income (NOI) by an impressive 50% (in their own words). After weeks of analyzing their operations, comparing P&Ls across various operators, and distilling these insights into a coherent business plan, the efficacy of their strategy is clear.

What is the target and where does it take place?

The strategy focuses on Central Paris, avoiding overly expensive prime sites for locations with good marketability in both sales and rentals. Central Paris, with its strong leasing demand from SMEs seeking both visibility and performance despite uncertain futures, emerges as the ideal setting. The aim is to secure small, well-situated, and well-connected spaces that cater to the needs of dynamic small businesses.

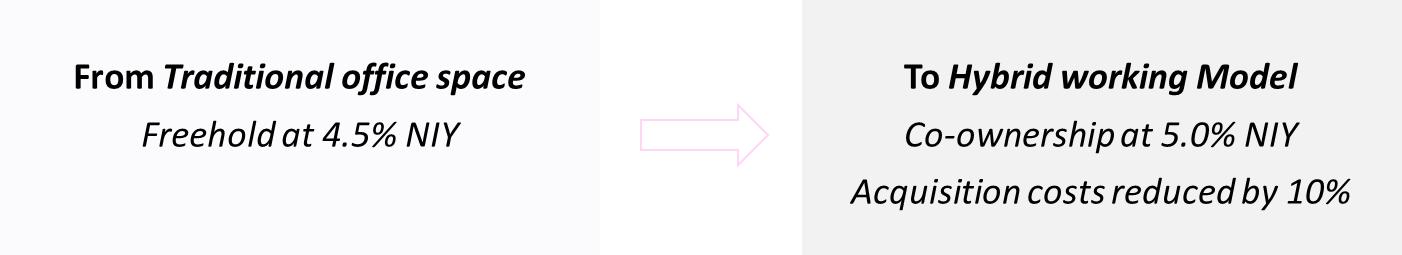

For simplicity, we will assume a 300 m² office floor plate that we will acquire in a co-ownership structure as it is rare to get this size opportunity in a freehold situation. Here is the first trick, the co-ownership structure might seem to diminish selling liquidity, but in the high-demand, strategically chosen locations, this is less of a concern. The long-term hold strategy compensates for this perceived downside, with the liquidity discount (an addition of 50bp to 75bps on the acquisition yield) viewed as an acceptable trade-off.

Providing a Plug and Play experience

The purpose is to offer flexibility users and that goes through:

Flexible Contracts: Given the market's lack of supply, the risk of vacancy for a 300 m² space is mostly theoretical, making it unnecessary and even counterproductive to bind users with long-term leases beyond a few months.

Turnkey Spaces: Providing fully furnished and equipped areas might incur costs, but it significantly saves time for both parties.

Essential Services: Aim for simplicity and efficiency, sidestepping the elaborate WeWork community vibe. Users should have reliable internet, access to printing facilities, and perhaps even regular fruit basket deliveries.

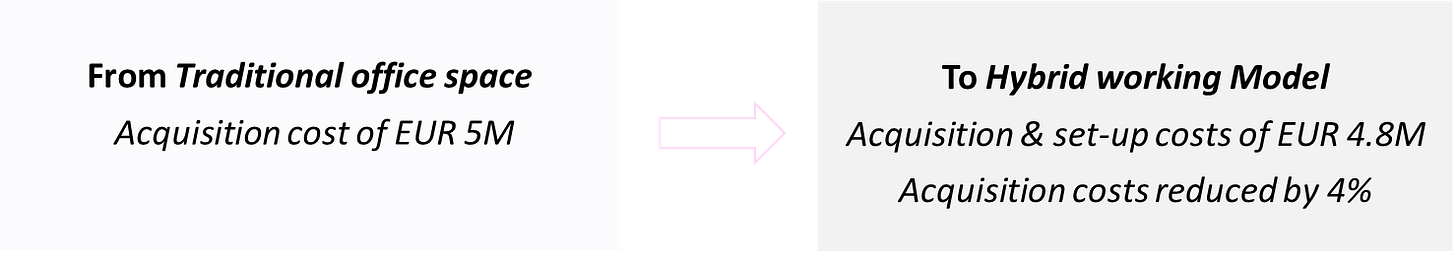

This will imply additional works, costs and set-up fees, somewhat diminishing the advantage of a co-ownership.

Then, the advantage in terms of capital invested remain limited and has too be carefully weighed against the co-ownership structure's constraints on exit strategies and management flexibility.

Revenue boost through active management

The real benefit of this strategy shines from a revenue standpoint. Being able to manage income in an under-supplied market is a substantial competitive edge.

In this case, adopting the hybrid working operator’s pricing model in the area means the flexibility offered to users can command a premium of 30% to 50% over the standard rent per workstation. This leads to several considerations: the vacancy rates inherent to the business model, tenant-covered charges, additional expenses from provided services, and, importantly, the amortization of provided furniture and fit-outs.

Conversely, providing a fully equipped space enables users to settle immediately with minimal cost. This consequently reduces the need for traditional incentive package (rent free period, TI’s, etc.) compared with traditional office’s standards.

In addition, this also presents an opportunity to for active yield management . While shorter contracts might command higher rates, there are also strategies to manage occupancy peaks—akin to methods used in the hospitality industry. With companies already prioritizing the management of office presence, it's an opportune moment to monetize this demand effectively.

Institutionalizing the Strategy

With a EUR 5 million deal generating robust income in a prime area, taking this strategy further involves amassing similar assets nearby using a classic horizontal platform strategy. This approach not only streamlines structural costs—potentially boosting income margins to 30-35%—but also creates a standardized portfolio under a master contract model (be it lease, variable lease, or management contract). Such standardization makes the portfolio instantly more appealing to institutional investors, offering the right mix of volume, desirable locations, and simplified management. This strategy paves the way for yield compression and mitigates liquidity concerns typically associated with co-ownership.

While the initial projection of a 50% increase in rental income may seem ambitious, there's realistic potential for a 20-35% improvement, along with various liquidity strategies depending on market cycles and expectations. The truly exciting aspect lies in the shift from purely managing costs to actively enhancing income. I learned over time that acquiring truly undervalued gems is to say the least unlikely, then focusing on buying well is a more prosperous long term story.

In conclusion, there is value to be unearthed through long-term Core strategies. The thing is not to be lazy sitting on steady income, it requires a carefully thought-out strategy and an proactive management. Traditional offices are, if not dying, certainly undergoing significant evolution. A blurred light twinkles on the horizon at the crossroads of hospitality management and hybrid working models.

Readers, your insights, challenges to the viewpoints shared, or suggestions for future discussions are more than welcome. Please don't hesitate to reach out!

See you next week!